According to Statifacts, the global clinical trials market size is calculated at USD 126.30 billion in 2025 and is expected to reach around USD 186.09 billion by 2034, growing at a CAGR of 4.4% from 2025 to 2034.

Ottawa, Feb. 13, 2025 (GLOBE NEWSWIRE) — The are deemed safe, the therapeutics are approved for widespread use in the pharmaceutical market, where they can be prescribed by healthcare providers.

The market is expected to grow significantly due to large-scale research and development efforts to develop new drugs. Big pharmaceutical companies, contract research organizations and government subsidies in the development of better healthcare infrastructure. Globalization has also played a massive role in expanding the demand for clinical trials, as medical research is now conducted at a university level in many emerging economies. Clinical trials are also widely conducted in regions such as the Asia Pacific due to the cost-effectiveness and a far more genetically diverse patient population. These factors are leading to significant growth in the clinical trials market.

The integration of artificial intelligence in the biotechnology sector has led to several breakthroughs. This also extends to the clinical trials market, with AI helping in analyzing large amounts of data generated in clinical trials. Machine learning algorithms are being leveraged to improve efficiency, reduce costs, and lead to better outcomes for clinical studies and trials. AI has applications at virtually every phase of clinical trials, right from the study design to post-market surveillance. Machine learning is used to determine the most accurate protocols for the trials, analyzing vast amounts of clinical and pre-clinical data to create the best study designs and tweaking trial parameters to improve study outcomes. They are also used to simulate clinical trials, help with patient recruitment at a significantly lower cost than before, and use natural language processing and image recognition to automate data capture from various resources. Clinical trials also require robust safety monitoring to ensure the tested drug or device does not cause adverse patient reactions. AI helps with the monitoring of real-world data to predict and prevent any harm that may arise from the trial substances. Overall, the use of artificial intelligence has played a major role in streamlining the planning and execution of runs in the clinical trials market.

Clinical Trials Market Key Takeaways

- North America accounted for 61.3% of the global market in 2024 and is expected to continue its dominance over the forecast period.

- Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period.

- Phase III segment led the market and accounted for 53.3% of the total revenue share in 2024.

- Phase II segment is expected to witness considerable growth over the analysis period.

- The interventional studies segment dominated the market in 2024. It is one of the most prominent methods used in clinical trials.

- The expanded access trials segment also referred to as compassionate use trials, is anticipated to register notable CAGR during the forecast period.

- The interventional trials market for autoimmune/inflammation accounted for the largest revenue share in 2024.

- Oncology segment accounted for the largest revenue share in 2024. As per the U.S. FDA and various other sources, more than USD 41.11 billion is currently being spent by the pharmaceutical industry

- Pharmaceutical & biopharmaceutical companies accounted for the largest revenue share in 2023.

- Patient recruitment and retention segment garnered a significant share in 2024.

- Data management segment held a significant share in 2024 and is anticipated to show a similar trend over the forecasted period.

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) ! https://www.statifacts.com/order-report/7734

Clinical Trials Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 126.30 billion |

| Revenue forecast in 2034 | USD 186.09 billion |

| Growth rate | CAGR of 4.4% from 2025 to 2034 |

| Actual data | 2019 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million and CAGR from 2024 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis |

| Segments covered | Phase, Study Design, Indication, Sponsor, Indication By Study Design, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country Scope | U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Clombia; South Africa; Saudi Arabia; UAE; Kuwait |

| Key companies profiled | Pharmaceutical Product Development, inc. (Thermo Fisher Scientific, Inc.), ICON plc, Charles River Laboratories International, Inc., IQVIA, Syneos Health, SGS SA, PAREXEL International Corporation, Wuxi AppTec, Inc, Chiltern International Ltd (Laboratory Corporation of America), Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Clinipace (Caidya) |

| Annual Subscription ; Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) ! https://www.statifacts.com/order-report/7734

Clinical Trials Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of the growth is accelerating. The clinical trials market is characterized by a moderate-to-high degree of growth owing to increasing investment in R&D programs, growing preference for outsourcing activities to minimize time, curtail clinical trial cost and patent expiration of blockbuster drugs. With increasing clinical trial privatization, there is a surge in outsourcing to developing countries, and many CROs are enhancing their global research network to provide better customer services.

Key strategies implemented by players in the clinical trials market are new product launches, expansion, acquisitions, partnerships, and other strategies. Thermo Fisher Scientific, in August 2023, announced the acquisition of CorEvitas, LLC (CorEvitas) for USD 912.5 million. The initial agreement to acquire CorEvitas was announced by Thermo Fisher on July 6, 2023.

Degree of Innovation: advancements in drug development, adoption of advanced therapies such as cell and gene therapy and rising demand for personalized medicine are likely to influence the industry growth. The market has seen a surge in innovative technologies such as AI, big data analytics, and remote monitoring. Companies are investing highly in advanced technologies and effectively utilizing these technologies often gain a competitive edge, driving market growth. Such advancements and innovations in clinical trials drive market growth.

- Impact of Regulations: Stringent quality protocols and regulatory norms by several nations to ensure patient safety and data integrity, which highly impact operational capabilities in the clinical trials market. Companies with robust compliance measures and a track record of fulfilling regulatory standards gain credibility and preference from biopharmaceutical sponsors. Compliance with these regulations demands substantial resources, leading to barriers for smaller or newer firms.

- Level of M&A Activities: Mergers and acquisition activities in the clinical trials market are increasing and witness similar growth during the analysis timeframe. Several companies are acquiring development-stage companies to enhance the company’s service portfolio to cater large patient pool. Moreover, these firms are integrating advanced facilities and form strategic alliances to achieve synergies in capabilities and resources, enhancing their competitiveness.

- Market Fragmentation: The market comprises a large number of bio-pharmaceutical, medical device manufacturers and CROS specialized in drug development leading to a fragmented scenario.

- Regional Expansion: The geographical distribution of clinical trials is slowly shifting from developed nations to emerging countries. The rising cost of clinical trials and difficulty in patient recruitment have led biopharmaceutical companies to shift toward regions like Central & Eastern Europe, Asia Pacific, Latin America, & Middle East for cost savings and quick patient recruitment. Emerging countries also possess greater disease variation compared to North America and Western Europe, where traditional diseases are growing.

Clinical Trials Market Trends

• Rising prevalence of chronic conditions: A rise in the incidence of chronic diseases such as coronary artery disease, diabetes, autoimmune diseases, cancers, and other neurological disorders is leading to significant investment in clinical trials to develop new therapeutics to combat them. As the global population continues to urbanize with a shift towards more sedentary lifestyles, the growing threat of pollution is also leading to more people developing these chronic conditions and needing treatment. The demand for more access to healthcare and therapeutics is leading to

• Growing geriatric population: The aging global population is another major factor contributing to growth in the clinical trials market. Elderly individuals are a lot more susceptible to chronic conditions that require priority medical attention and care. Pharmaceutical companies are increasingly focusing on age-related diseases, and therapeutics are being developed to cater to the older population and improve their quality of life.

• The advent of personalized medicine: The growth of increasingly tailor-made treatments based on individual patient lifestyle, environment, and, more importantly, genetic makeup is going a long way in improving patient outcomes. An improved understanding of DNA sequencing and how it affects genetic presentation is helping researchers and healthcare providers get a better understanding of which targeted therapies to prescribe to individual patients. This has led to the conducting of specialized clinical trials, such as umbrella and basket trials, which divide patients based on genetic makeup.

• Federal support and speedy approvals: Government healthcare agencies and regulatory bodies are developing streamlined approval processes to speed up the availability of treatments for certain debilitating conditions. The United States FDA (Food and Drug Administration) and the European Medicines Agency have introduced fast-track mechanisms to speed up trial phases and treatment approval to meet growing medical needs.

Buy this Databook (USD1550) https://www.statifacts.com/order-report/7734

Global Clinical Trials Market Report Segmentation Insights

Phase Insights

By phase, the phase III segment registered its dominance over the global clinical trials market. Phase III trials are usually conducted on a wide scale, usually with several thousand patients involved. This widespread testing of the drug streamlines the generation of data about a particular therapeutic’s safety and efficacy. Most phase III trials are randomized and blinded, the golden standard for drug testing. The increased demand for new therapeutics and the evolution of stringent testing protocols are allowing researchers and healthcare providers to conduct a larger number of phase III trials. Advancements in artificial intelligence, machine learning, and their application in data analytics are leading to smoother patient recruitment, data collection, and analysis. The growing biomedical and pharmaceutical sector is leading to breakthroughs in oncology, immunology, and the treatment of other chronic conditions.

By phase, the phase II segment is anticipated to grow with the highest CAGR in the market during the studied years. A widespread focus on targeted therapies, especially with the rise of personalized medicine, is leading to notable growth in the conduction of phase II trials. Phase II trials test the drugs or devices on a smaller group of patients, with strict safety and efficacy standards. Advancements in biotechnology and the development of state-of-the-art cell therapies and treatments are prompting demand in the segment. Many emerging markets, especially in regions such as the Asia-Pacific and Africa, are becoming meccas for clinical trial conduction. The larger, more genetically diverse patient pools, significantly lower costs, and local federal incentives are propelling growth in the segment.

Study Design Insights

By study design, the interventional studies segment held a dominant presence in the market in 2024. Interventional studies are used with participants where healthcare providers are actively given a specific new drug, medical device, or treatment and procedure to evaluate its effects on their health. These studies are carried out to collect as much information as possible about patient reactions to new therapeutics, especially of novel medication. The rapid growth of the biotechnology and pharmaceutical sector is allowing for large-scale investment in interventional studies and advanced therapies such as cell-based treatments.

By study design, the observational studies segment is expected to be the fastest-growing market. Observational studies are crucial for real-world use of therapeutics, including how often the treatment schedule is being adhered to and any issues patients encounter while trying to access and use various therapeutics. These studies are vital in determining realistic patient outcomes, survival rates, and quality of life of patients. Researchers can also determine the efficacy of treatments on populations with a diverse genetic makeup. Observational studies look at healthcare inequities, resource use, and delivery systems.

Indication Insights

By indiction, the oncology segment registered its dominance over the global market in 2024. A rising incidence of various types of cancers due to exposure to microplastics, lifestyle changes such as smoking, poor diet, and alcohol consumption, along with environmental factors, are leading to a spike in cancer cases worldwide. This is propelling significant demand for clinical trials in the oncology segment. As cancer incidence grows, so does the funding for cancer research and advances in treatments. New therapies are being developed that are less invasive compared to traditional cancer treatments, such as radiation and chemotherapy. This has led to advances in specialized treatments and opened up new channels to manage and cure various cancers.

By indication, the cardiovascular segment is set to grow the fastest in the clinical trials market. The widespread incidence of coronary artery disease and related heart conditions, such as stroke and hypertension, are among the leading causes of death globally. In response to this, there have been several advancements in new cardiovascular therapeutics, medical devices, and treatment options. New drug classes for hypertension, anticoagulants, and the treatment for heart failure have made it possible to manage cardiovascular health more effectively and lead to better patient outcomes and quality of life. As healthcare infrastructure improves, especially in emerging economies, and awareness increases in these regions, more people are being diagnosed and treated for cardiovascular conditions, expanding the market.

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) ! https://www.statifacts.com/order-report/7734

What Makes North America the leader in the Clinical Trials Market ?

The U.S. clinical trials market size was exhibited at USD 41.19 billion in 2024 and is projected to hit around USD 75.95 billion by 2034, growing at a CAGR of 6.31% during the forecast period 2024 to 2034.

By region, North America held a significant share of the clinical trials market in 2024. High obesity rates, the emergence of pharmaceutical giants, and increasing regulatory incentives in the healthcare sector have led to massive growth in the region. The demand for novel therapeutics and treatment protocols for a variety of conditions, such as cardiovascular disease, autoimmune disorders, and cancers, is leading to massive undertakings of clinical trials to verify the safety and efficacy of new treatments. Notable investments in healthcare, in the public and private sectors, are driving the growth of clinical trials with pharmaceutical companies, increasing their research and development spend on clinical research. The fast-track drug approval policy by the U.S. Food and Drug Administration (FDA) has also created significant investment and the speedy conduction of trials in the United States.

By region, the Asia Pacific region is anticipated to grow at the fastest rate in the market during the forecast period. A massive patient pool, low cost of conduction, favorable regulatory incentives, and streamlined approval processes are making the region an attractive location for large pharmaceutical companies in the United States and Europe to outsource clinical trials to the region. A robust contract research organization (CRO) market within the region offers companies access to expertise and infrastructure for conducting clinical trials.

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Clinical Trials Market Top Key Companies:

- Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.)

- ICON plc

- Charles River Laboratories International, Inc.

- IQVIA

- SYNEOS HEALTH

- SGS SA

- PAREXEL International Corporation

- Wuxi AppTec, Inc

- Chiltern International Ltd (Laboratory Corporation of America)

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Clinipace (Caidya)

Recent Developments:

- In February 2024, BioNTech’s oncology vaccine trial saw massive success, with all patients living kidney cancer-free. Researchers from the US-based Dana-Farber Cancer Institute administered BioNTech’s NeoVax personalized cancer vaccine to all nine patients with stage III or IV clear cell renal cell carcinoma (ccRCC) following tumor removal surgery.

- In February 2024, a New Zealand-based medical device company called Wellumio pioneered advancements in stroke detection, today announced the enrollment of the first patient in the feasibility, safety, and usability assessment of the Wellumio ‘Axana’ 0.1T portable magnetic resonance imaging device (Portable MRI study). This will study the ability of the Axana device to detect acute stroke in ED patients.

- In August 2023, Parexel & Partex entered a strategic partnership aimed at utilizing Artificial Intelligence (AI)-driven solutions to expedite the process of drug discovery and development for biopharmaceutical clients globally. The collaboration aimed to reduce risks associated with the assets in their respective portfolios.

- In August 2023, Novo Nordisk announced to acquire Inversago Pharma. This acquisition was part of Novo Nordisk’s strategic efforts to develop new therapies targeting individuals with obesity, diabetes, and other significant metabolic diseases

Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Statifacts has segmented the global Clinical Trials Market

- By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

- By Study Design

- Interventional

- Observational

- Expanded Access

- By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson’s Disease (PD)

- Huntington’s Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

- Autoimmune/Inflammation

- By Indication by Study Design

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Condition

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

- Autoimmune/Inflammation

- By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

- By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Elevate your business strategy with market-driven insights—purchase the report today ( Price USD1550) ! https://www.statifacts.com/order-report/7734

Browse More Research Reports;

- U.S. Clinical Trials Market : The U.S. clinical trials market size was exhibited at USD 41.19 billion in 2024 and is projected to hit around USD 75.95 billion by 2034, growing at a CAGR of 6.31% during the forecast period 2024 to 2034.

- U.S. Cardiovascular Clinical Trials Market : The U.S. cardiovascular clinical trials market size was exhibited at USD 3,449 million in 2024 and is projected to hit around USD 6,722 million by 2034, growing at a CAGR of 6.9% during the forecast period 2024 to 2034.

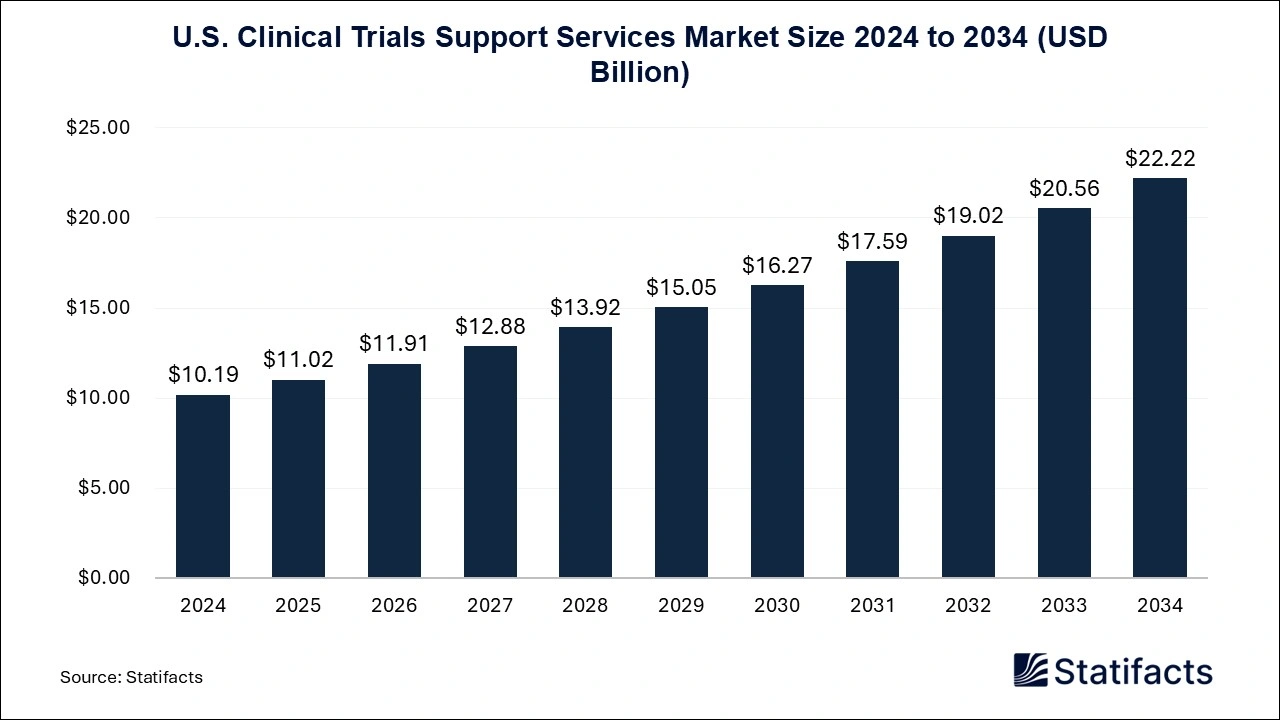

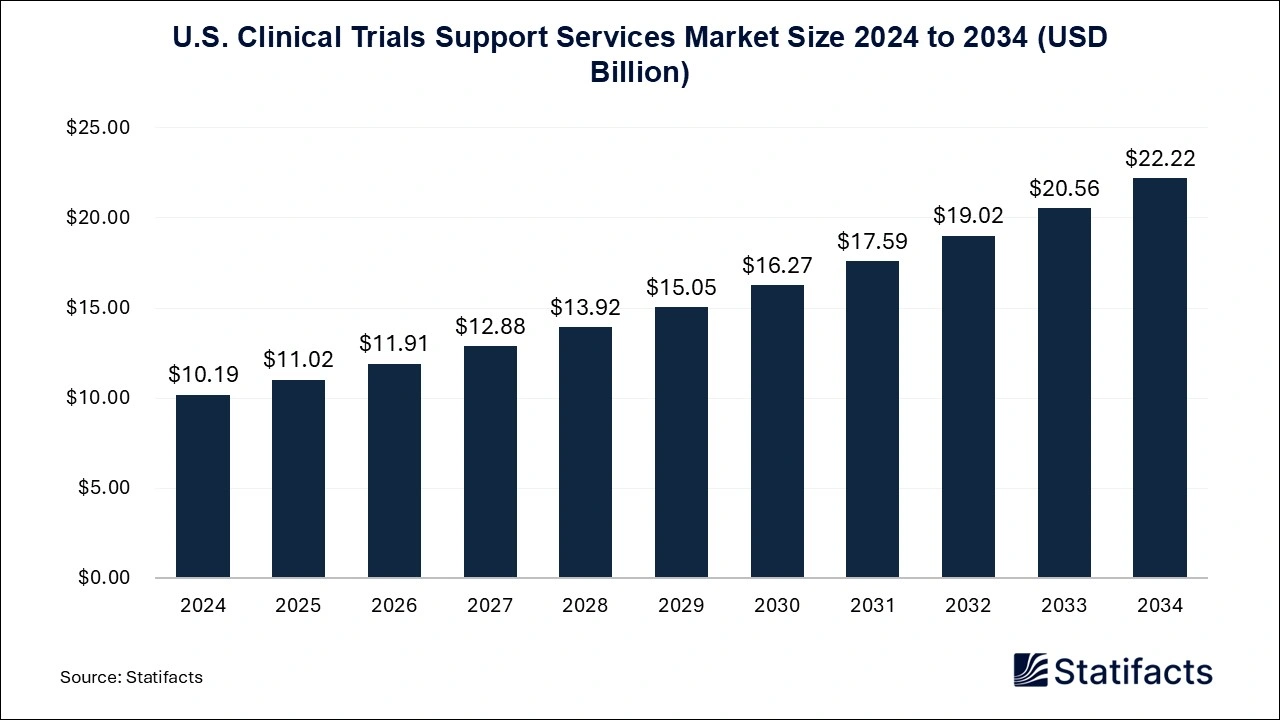

- U.S. Clinical Trials Support Services Market : The U.S. clinical trials support services market size is calculated at USD 10.19 billion in 2024 and is predicted to reach around USD 22.22 billion by 2034, expanding at a CAGR of 8.11% from 2024 to 2034.

- U.S. AI-based Clinical Trials Solution Provider Market ; The U.S. AI-based clinical trials solution provider market size is calculated at USD 919 million in 2024 and is predicted to reach around USD 6,897 million by 2034, expanding at a CAGR of 22.33% from 2024 to 2034.

- U.S. Virtual Clinical Trials Market : The U.S. virtual clinical trials market size was exhibited at USD 7,519 million in 2024 and is projected to hit around USD 12,795 million by 2034, growing at a CAGR of 5.46% during the forecast period 2024 to 2034.

- U.S. Oncology Clinical Trials Market : The U.S. oncology clinical trials market size is calculated at USD 7,919 million in 2024 and is predicted to reach around USD 12,416 million by 2034, expanding at a CAGR of 4.6% from 2024 to 2034.

- U.S. Clinical Trials Supply And Logistics Market : The U.S. clinical trials supply and logistics market size was exhibited at USD 1,319 million in 2024 and is projected to hit around USD 2,744 million by 2034, growing at a CAGR of 7.6% during the forecast period 2024 to 2034.

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here – https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Email: sales@statifacts.com

- Web: https://www.statifacts.com/

- Europe : +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

For Latest Update Follow Us:

Statifacts | Precedence Research| Towards Healthcare

The post Clinical Trials Market Size to Hit Around USD 186.09 Billion by 2034 first appeared on CXP – Customer Experience Asia.