The global veterinary CRO and CDMO market size is estimated at USD 7.73 billion in 2025 and is projected to reach around USD 15.98 billion by 2034, growing at a healthy CAGR of 8.4% from 2025 to 2034.

Ottawa, Feb. 11, 2025 (GLOBE NEWSWIRE) — According to Precedence Research, the

Veterinary CRO and CDMO Market Key Highlights:

- North America led the global veterinary CRO and CDMO market with the largest market share of 35% in 2024.

- Europe is expected to grow at the fastest CAGR during the forecast period.

- By animal type, the livestock animal segment has held the highest market share of 47% in 2024.

- By animal type, the companion animal segment is projected to grow at a double-digit CAGR of 11.8% during the forecast period.

- By service type, the development segment contributed the maximum market share of 32% in 2024.

- By service type, the discovery segment is expected to grow at the fastest CAGR over the projected period.

- By application, the medicine segment accounted for a major market share of 71% in 2024.

- By application, the medical devices segment is growing at the fastest CAGR over the projected period.

Market Overview and Industry Potential

The veterinary CRO and CDMO refer to the specialized services provided by contract research organizations and contract development and manufacturing organizations for veterinary animals. These services are specifically intended for companion animals and livestock animals to provide them with healthcare products and veterinary drugs. These CRO and CDMO services assess the safety and efficacy of veterinary drugs, medications, etc.

CROs and CDMOs are widely applicable to pharmaceuticals, biologics, medical devices, and medicines. They assist in formulation development, process optimization, production, drug discovery, manufacturing, labeling, packaging, market approval, and post-marketing. They help in drug discovery and the development of new therapeutic interventions to treat or prevent diseases in veterinary animals. They assist in target and lead identification, target validation, and lead optimization. They also play major roles in the development processes like pre-clinical and clinical stages, and regulatory consulting.

In Manufacturing, the prominent roles are API manufacturing, finished dose formulation, and analytical services. The leading industries contributing to the growth of the veterinary CRO And CDMO market are Covance Inc., Syneos Health, Medpace, Merck Animal Health, Envigo, etc.

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

Role of Artificial Intelligence in the Veterinary CRO And CDMO Market

The integration of artificial intelligence into veterinary clinical practice enhances the quality of veterinary care which includes improved medicine delivery and treatment outcomes for animals. AI applies to a wide range of research areas such as cancer research, antimicrobial resistance research, drug design and vaccine development, disease surveillance, epidemiology, and genomics.

Radiomics, a cutting-edge technology in precision medicine uses advanced mathematical analyses for medical imaging. AI plays a vital role in animal health by facilitating the operation of complex subjects. AI can manage predictive and quantitative epidemiology, host-pathogen interactions, and precision-based therapeutics. AI contributes to the precise diagnosis of animal diseases with minimal errors by offering risk assessment, target-specific interventions, treatment solutions, and biological interactions.

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Major Trends in the Veterinary CRO And CDMO Market

- New Product Development in Veterinary Soft Chew Technology:

The innovative soft chewable solutions emerged to offer a flexible dosing alternative. These soft chewables offer many benefits to veterinarians, animal owners, and veterinary medicine developers. These products are available in soft textures and better taste which become more suitable to digest by companion animals. These soft textures enable easy and efficient oral API dosing to animals at home. They offer greater regulatory compliance and better treatment outcomes. The soft chews are in high demand by animals and thus offer wider opportunities to their manufacturers to produce a large-scale API dosing to deliver therapeutic impact. The developers are capable of enhancing bioavailability by using additional ingredients as per the needs.

- Increased Focus on Sustainable Manufacturing: The developers of soft chew products, API dosages, or any veterinary medications highly prefer to adopt sustainable practices in the development, manufacturing, and other industrial processes. Some of the key industrial steps in making the products stable and more efficient include formulation, assessing water content, and palatability. The developers must formulate a complex mix of ingredients to develop a soft chew product with the right properties. They must identify suitable stabilizers and plasticizers and should add the right amount of lipids to make the superior taste masking. These steps must be done without compromising API stability, product release profile, and API solubility. In addition, developers try to understand the use of minimal water content to produce soft chews and API products to enhance better sensory experience for desired animals. Moreover, developers adhere to a strong technical awareness, a deep understanding of soft chew products, and the regulatory approvals for the invented products.

Geographical Analysis:

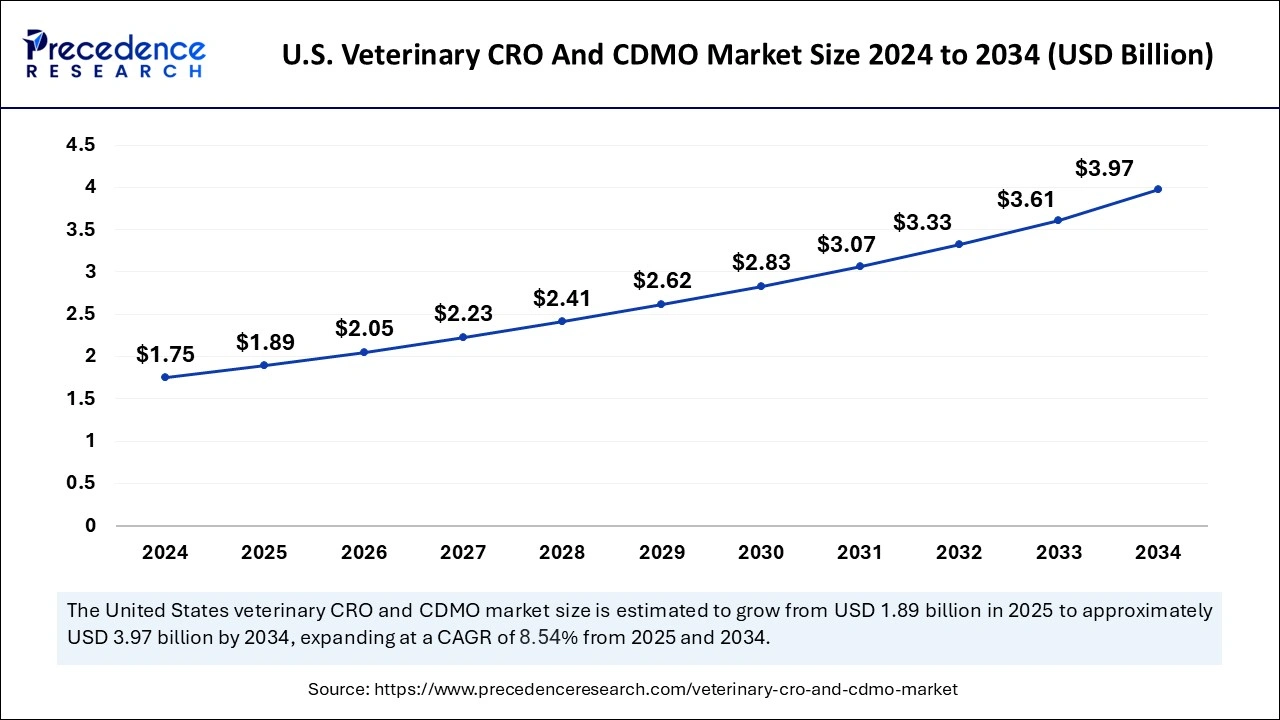

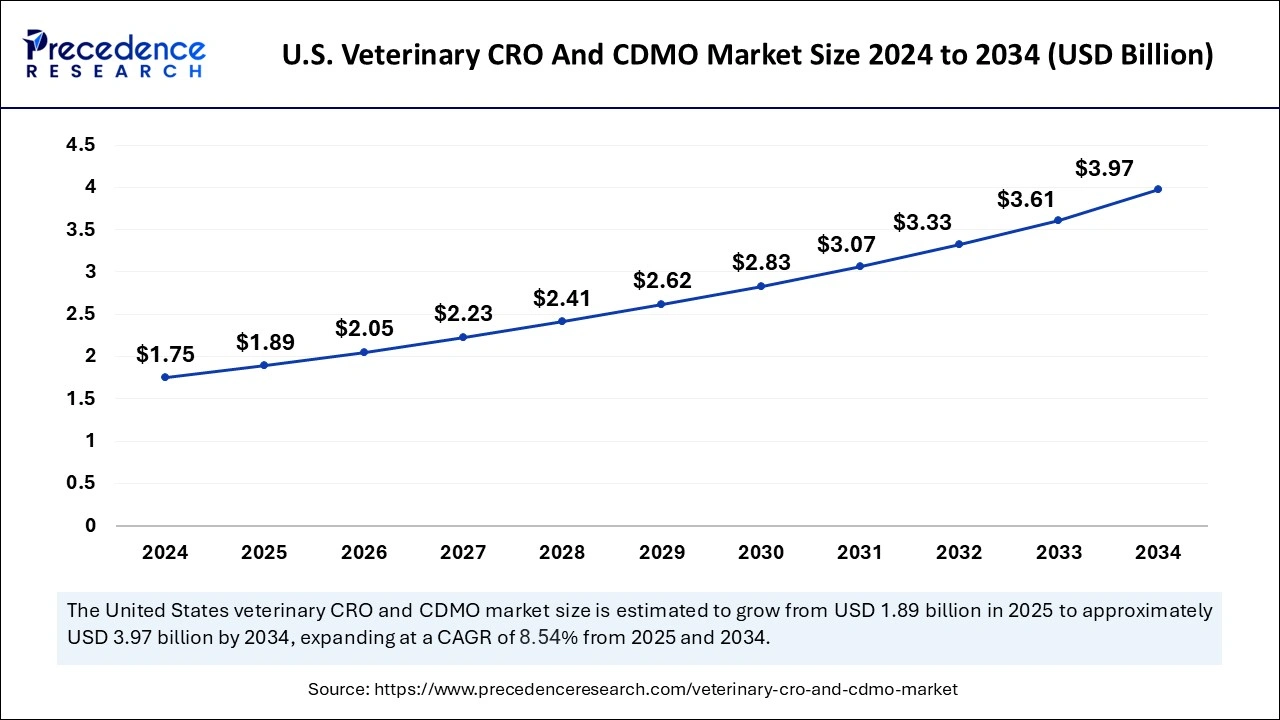

U.S. Veterinary CRO and CDMO Market Size and Forecast 2025 to 2034

The U.S. veterinary CRO and CDMO market size reached USD 1.75 billion in 2024 and is expected to hit around USD 3.97 billion by 2034. The sector is projected to expand at a solid CAGR of 8.54% during the forecast period.

North America dominated the veterinary CRO And CDMO market in 2024 due to several emerging trends in CRO and CDMO services for veterinary animals. The growing focus of this region on personalized medicine for pets drives the development of specialized veterinary pharmaceuticals and services. The significance of regulatory compliance and pharmacovigilance is increased which ensures the safety and efficacy of veterinary drugs.

Moreover, the collaborations between pharmaceutical industries and academic institutions boost innovations. The huge adoption of advanced digital technologies like artificial intelligence and data analytics assists in enhancing research and development efficiency. North America focuses on providing cutting-edge veterinary medicines and required solutions and stays a leading hub for animal health innovation.

- In January 2025, the U.S. Food and Drug Administration (USFDA) released a Request for Information (RFI) to obtain comments from the public or veterinarians regarding the uses of cannabis-derived products (CDP) in animals.

- In January 2025, the U.S. Food and Drug Administration (USFDA) released a Request for Comments (RFC) to obtain public comments on emerging opportunities and monitoring needs to develop the National Antimicrobial Resistance Monitoring System (NARMS) Strategic Plan for 2026-2030.

Europe is expected to be the fastest-growing region in the veterinary CRO And CDMO market during the forecast period due to notable emerging trends in these services and solutions. Europe showcases a strong preference for animal welfare and stringent regulatory compliance which drives the demand for high-quality veterinary pharmaceuticals. Moreover, the collaborations between European pharmaceutical companies and CRO or CDMO service providers boost innovations.

The growing animal health awareness and the increased preference for pet ownership in Western European countries contribute to the market’s growth noticeably. The integration of digitalization with advanced technologies like digital health records and telemedicine is greatly impacting veterinary research including development processes and ensures efficient services and product delivery.

- In December 2024, the Committee for Veterinary Medicinal Products (CVMP) adopted a positive opinion by consensus for a marketing authorization application for Icthiovac ERM from laboratories Hipra, S.A which is a new vaccine for the active immunization of Atlantic salmon fry to decline mortality rates caused by serotype O1 (biotypes 1 and 2) and serotype O2 (biotype 1) of Yersinia ruckeri in freshwater.

- In May 2024, the new legislation introduced in the parliament of Great Britain which are the new veterinary medicines regulations came into force from May 2024. This legislation will set out controls over the marketing, manufacturing, distribution, possession, and administration of veterinary medicines and medicated feed.

Veterinary CRO And CDMO Market Scope

| Report Coverage | Details |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Size in 2025 | USD 7.73 Billion |

| Market Size by 2034 | USD 15.98 Billion |

| CAGR from 2025 to 2034 | 8.4 Percent |

| Leading Region in 2024 | North America |

| Segments Covered | Animal Type, Service Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Veterinary CRO And CDMO Market Segment Analysis:

Animal Type Analysis

The livestock animal segment dominated the veterinary CRO And CDMO market in 2024 due to the use of livestock animals for several purposes which include meat, milk, and other agricultural products. The rising demand for specialized veterinary pharmaceuticals and vaccines for raising productivity and livestock health. With the growing livestock production, the need for R&D services is also growing which ensures the safety and efficacy of animal health products.

The growing importance of sustainable and eco-friendly practices in livestock farming accelerates innovations within the veterinary CRO And CDMO market. This increased focus propels the development of novel veterinary solutions that are specifically designed for livestock animals. These efforts align with industrial commitments to responsible and environment-friendly agricultural practices.

The companion animal segment is expected to be the fastest-growing in the veterinary CRO And CDMO market during the forecast period due to a large number of companion animals including pets, dogs, cats, and small mammals. The growing shift towards personalized healthcare solutions for companion animals also drives this segmental growth.

The development of advanced diagnostics, specialty drugs, and tailored treatments boosts the growth of this segment in the market and increases the importance of pets in the lives of people. The growing demand for telehealth services for companion animals enabled remote consultations and remote monitoring by considering the importance of personalized and accessible veterinary care.

Service Type Analysis

The development segment dominated the veterinary CRO And CDMO market in 2024 due to research and development activities for veterinary pharmaceuticals, biologics, formulation development, pre-clinical, and clinical trials, and regulatory support. The rising shift towards personalized veterinary medicine and the rapid advancements in gene therapies and biologics drive the growth of this segment.

The integration of cutting-edge technologies like artificial intelligence and real-world evidence generation boosts the demand and need for the development segment. The emerging trends support innovations and the establishment of new, safe, and effective solutions that are designed to meet the specific healthcare needs of animals.

The discovery segment is expected to be the fastest-growing in the veterinary CRO And CDMO market during the forecast period due to the importance of R&D, discovery of novel compounds, and new treatment approaches. It enables the identification and evaluation of veterinary pharmaceuticals.

The phases of any new drug discovery involve target identification, lead optimization, and pre-clinical testing. The emerging trends in discovery include the increased focus on innovative drug candidates in specific areas like zoonotic disease prevention and personalized medicine for animals. Advancements in bioinformatics and genomics accelerated the discovery processes which allows researchers to identify new drug targets and develop more effective veterinary therapies.

Application Analysis

The medicines segment dominated the veterinary CRO And CDMO market in 2024 due to the huge demand and need for medicines, pharmaceuticals, vaccines, and therapeutic solutions for improving animal health. The growing focus on personalized and species-specific medicines aligns with the rising awareness of designed treatments for diverse animal species.

Moreover, the new scientific innovations in gene therapies and biologics are gaining momentum as they offer novel approaches to fulfill several veterinary healthcare needs. These emerging trends meet with the industry’s commitments to advance veterinary medicines and enhance the well-being of animals all across the world.

The medical devices segment is expected to grow at the fastest rate in the veterinary CRO And CDMO market over the forecast period due to the wide applications of medical devices in the development and manufacturing of veterinary medical equipment and diagnostic devices.

The adoption of several products including surgical instruments, imaging tools, monitoring devices, and diagnostic tools designed for animal healthcare drives the growth of this segment prominently. Moreover, innovations in telemedicine and remote monitoring devices are transforming veterinary diagnostics and animal healthcare by providing access and convenience to veterinarians and pet owners.

Browse More Press Releases:

- Biopharmaceutical CMO and CRO Market Size, Share and Trends 2025 to 2034: The global market size accounted for USD 38.56 billion in 2024 and is expected to exceed around USD 72.39 billion by 2034, growing at a CAGR of 6.50% from 2025 to 2034.

- Pharmaceutical CRO Market Size, Share and Trends 2024 to 2034: The global market size is calculated at USD 44.58 billion in 2024 and is anticipated to reach around USD 91.20 billion by 2034, expanding at a CAGR of 7.42%.

- Pharmaceutical CDMO Market Size, Share, and Trends 2024 to 2034: The global market size is estimated at USD 184.90 billion in 2024 and is anticipated to reach around USD 368.70 billion by 2034, expanding at a CAGR of 7.2%.

- Animal Diagnostics Market Size | Share and Trends 2024 to 2034: The global market size accounted for USD 9.06 billion in 2024 and is expected to reach around USD 14.76 billion by 2034, expanding at a CAGR of 5%.

- Preclinical CRO Market Size, Share, and Trends 2025 to 2034: The global market size was USD 5.82 billion in 2023, accounted for USD 6.28 billion in 2024, and is expected to reach around USD 12.34 billion by 2033, expanding at a CAGR of 7.8%.

- In Vivo CRO Market Size, Share and Trends 2024 to 2034: The global in market size is projected to be worth around USD 10.89 billion by 2034 from USD 4.99 billion in 2024, at a CAGR of 8.11%.

- Animal Biotechnology Market Size, Share, and Trends 2025 to 2034: The global market size was USD 26.49 billion in 2023, calculated at USD 28.93 billion in 2024 and is expected to reach around USD 69.88 billion by 2034.

- Dermatology CRO Market Size, Share, and Trends 2024 to 2034: The global market size is estimated at USD 4.48 billion in 2024 and is anticipated to reach around USD 8.09 billion by 2034, expanding at a CAGR of 6.10% from 2024 to 2034.

- Animal Vaccine Market Size, Share, and Trends 2024 to 2034: The global market size accounted for USD 17.27 billion in 2024 and is expected to be worth around USD 44.79 billion by 2034, at a CAGR of 10% from 2024 to 2034.

- Artificial Intelligence (AI) In Animal Health Market Size, Share, and Trends 2024 to 2034: The global market size is expected to be valued at USD 1.41 billion in 2024 and is anticipated to reach around USD 8.23 billion by 2034, expanding at a CAGR of 19.3%.

Competitive Landscape and Major Breakthroughs in the Veterinary CRO And CDMO Market

The veterinary CRO And CDMO market continues to evolve rapidly and showcases significant advancements through innovations in 2023 and 2024, with a dynamic competitive landscape. Major players such as Veterinary Research Management, Vetio Animal Health, Parexel International Corporation, Charles River Laboratories International Inc., ICON Plc, etc. hold a prominent position in the veterinary CRO And CDMO market. These companies exhibit promising resources and technical expertise to conduct clinical research and R&D activities in diverse research areas and provide fruitful clinical and biopharmaceutical outcomes.

What is Going Around the Globe?

- In October 2024, Argenta, the global animal health pharmaceutical services company announced the acquisition of the manufacturing site in Shawnee, Kansas, USA from TriRx Pharmaceuticals to stay dedicated to animal health.

- In May 2024, the Pharmaceuticals Export Promotion Council of India (Pharmexcil) announced the inauguration of online stall reservations for the 10th edition of iPHEX from May 2024.

Segments Covered in the Report:

By Animal Type

- Companion Animals

- Livestock Animals

By Service Type

- Discovery

- Development

- Manufacturing

- Packaging & Labeling

- Market Approval & Post-marketing

By Application

- Medicines

- Medical Devices

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3353

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

Towards Healthcare | Towards Packaging | Statifacts | Towards EV Solutions | Towards Dental | Towards Automotive | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For Latest Update Follow Us:

The post Veterinary CRO and CDMO Market Size Projected to Reach USD 15.98 Bn By 2034 first appeared on CXP – Customer Experience Asia.